Frequently Asked Questions

The most popular questions and answers about Aliyah and life and Israel

Frequently Asked Questions

The most popular questions and answers about Aliyah and life and Israel

- MAKING ALIYAH

- LIFE IN ISRAEL

- ELIGIBILITY

- ALIYAH PROCESS

- PRACTICAL PLANNING

Am I eligible to make Aliyah?

In order to qualify for making Aliyah, you must meet at least one of the following conditions:

- you are Jewish (born to a Jewish mother or converted to Judaism by a Rabbinical Court recognized by the State of Israel), or

- you have a Jewish father or grandfather, or

- you are married to an eligible person, or

- you are a widow/er of a Jewish spouse

In addition, you must meet the following conditions:

- you do not to pose a risk to the national security of Israel

- you do not to pose a risk to the public health

Are you still in doubt? Click here to get more information.

I am Jewish, but my spouse is not. Can we both make Aliyah?

If you are not yet an Israeli citizen, yes.

I can't find proof about my Jewish roots, how can I prove that I am Jewish?

Look for the community or Rabbi who knew your parents and grandparents. You will need an official letter of eligibility from the Rabbi or official Jewish community to prove your eligibility. More information on the requirements for the letter can be found here.

Can I let my eligibility get checked by the Jewish Agency before gathering all the rest of the required documents?

Actually, you must have the Jewish Agency verify your eligibility first. Only then will you know which documents are required in your case.

How can I find out whether my conversion is recognized?

You must open an application file with the Jewish Agency and submit the conversion documents for verification.

Can I get an Israeli passport without making Aliyah?

If your parents are not Israelis and you were not born in Israel or have previously made Aliyah, the only way to obtain a passport is by making Aliyah.

I am Israeli, but I lived abroad for a while. Am I a Toshav Chozer?

Who qualifies for the status of Toshav Chozer and what you must do when returning to Israel, is explained in this guide.

I want to live in Israel but I'm not sure if I want to make Aliyah. Is there an alternative option?

If you are eligible for Aliyah but you are not sure if it is the best option for you, the Ministry of the Interior offers the possibility of temporary residence (A1 visa). See our guide here.

What are the requirements for obtaining the A1 residence visa in Israel?

If you are eligible for Aliyah, you are also eligible for the A1 visa.

Why should I make Aliyah?

Am Yisrael (the Jewish People) has the privilege to return to the Land of Israel under Jewish rule, after more than 2,000 years living in the Diaspora. Nowadays it’s pretty convenient to make Aliyah and move to Israel, compared to how it was in the beginning of the return to the land of Israel (starting some 140 years ago). It nevertheless requires good preparation and readiness to accept and adjust to a new reality. It’s not easy, but worthwhile. You and your family can spend the rest of your life in the Land of Israel. There are also other aspects and reasons that can be beneficial, such as education, Jewish communities, Jewish culture and business/professionally related considerations. It is important to really want to make Aliyah in order to overcome the first bumps after coming to Israel, we therefore recommend to have a strong ideological base for taking this step.

How do I make Aliyah?

Depending on your personal (family) situation, your background and the countries you (and your family members) lived in, you will need to gather a number of documents and get approval on your eligibility for Aliyah from the Jewish Agency for Israel. Click here to start your Aliyah, and here to understand more about the whole process and documents.

How do I begin my Aliyah process?

To begin your Aliyah process, you must personally call the Jewish Agency’s Global Center. You will need to answer some preliminary questions and will be informed about your eligibility and about how to proceed. You can find the phone number for your country here.

How long does the Aliyah process take?

The Aliyah process usually lasts between 6 months to 1 year, depending on many factors such as the applicant’s status and the length of time it takes to submit documents. You can find a rough timeline here.

Which documents do I need to make Aliyah?

Depending on your background, family situation and countries you have resided in you need different documents. Click here to learn more about the specific documents you need.

How do I get an apostille on my documents?

This differs per country. You can find more information on each country here.

How do I get my criminal background check?

This differs per country. You can find more information here.

How up to date must the documents be to be valid for the Aliyah application?

The passport is valid for the period specified therein. The police clearance must not be older than 6 months. The other documents (such as marriage, birth, death certificates, etc.) do not have an expiration date. As long as they are apostilled, they are valid. Note that the proof of Judaism might be valid for only one year, depending on the verification and requirements of the Jewish Agency and Misrad HaPnim.

I am divorced. Do I have to submit my marriage documents in addition to my divorce papers?

You need to submit both documents – the marriage certificate as well as the divorce certificate – each of them with apostille.

Which documents require a notarial translation and for which ones does a simple translation suffice?

Don’t translate any documents unless you are explicitly required to do so. In the majority of the cases the Jewish Agency will do the translations.

Do I need to pay?

The Jewish Agency charges a one-time fee for opening the application. The amount differs in each country and depends on the number of family members making Aliyah together.

I have a pet that I want to bring to Israel, how do I arrange this?

There are several things to arrange beforehand when making Aliyah with a pet. Your pet has to have a microchip and be vaccinated proven by a serological test. Besides that, there is some paperwork to do. You can find more details here.

I am already in Israel on a tourist visa, how can I make Aliyah?

You need to call the Jewish Agency or book an appointment at Misrad HaPnim in order to open a Shinui Ma’amad (שנוי מעמד) Change of Status file. You will be asked to present several documents and forms. Please keep in mind that you must have all the original documents with you to be able to have an interview.

How long does it take to make Aliyah from within Israel (shinui status)?

It usually takes about 3-6 months.

Is it quicker to make Aliyah from abroad or from within Israel (shinui status)?

Making Aliyah from within Israel (shinui status) is usually faster.

If a person begins the regular Aliyah process from abroad, can he continue and complete the process in Israel, i.e. change his status while in the country?

The process of making Aliyah from abroad is different from initiating Shinui Ma’amad status (Aliyah from within Israel). If you have begun the Aliyah process abroad, you will be able to use the already submitted documents. However, there are a number of additional forms to fill out. You must call the Jewish Agency and open a file for Shinui Ma’amad status. This process is explained in this guide.

What is the difference between the A1 visa and Aliyah?

The A1 visa is valid for 1 year and can be renewed annually. Having an A1 visa does not oblige you to serve in the army. Neither does it entitle you to receive the benefits of new immigrants (such as Sal Klita, discounts, ulpan, health insurance, etc.). Furthermore, the A1 visa holder does not receive an Israeli passport and must arrange private health insurance for his stay in Israel.

How can I apply for an A1 residency visa in Israel?

If you are abroad, contact the Jewish Agency’s Global Center. Find the phone number for your country here. If you are in Israel, make an appointment with the Ministry of the Interior in your city.

What documents are required to obtain the A1 residence visa?

See our guide for the entire list of documents you must submit.

Why are Ishurei Giyur - אישורי גיור - conversion letters, required for Aliyah?

Certain letters are essential for Aliyah after conversion to provide a comprehensive understanding of the conversion process and the applicant’s involvement in the Jewish community.

It is crucial to provide the list of required documents to the Rabbi, teacher, or community leaders who can assist in gathering the required letters.

Which letters are required, and what are their purposes?

- Letter Dealing with the Pre-Conversion from the Rabbi/Teacher or Community Leaders:

Provides details on the preparation for conversion.

Includes information about studies, activities, and interactions with the Rabbi.

Specifies the Beit Din details and mentions family members’ conversions if relevant. - Letter Detailing Communal Participation from the Rabbi/Teacher or Community Leaders:

Describes the applicant’s participation in the Jewish community.

Covers activities before, during, and after conversion.

Can be signed by three official members of the board of directors in the absence of a Rabbi. - Letter from External Beit Din (If relevant):

Clarifies the connection between the Beit Din and the applicant’s synagogue.

Explains the choice of the external Beit Din.

What are the requirements for the letters?

All letters must be dated and ink-signed.

Letters by Rabbis or teachers should be on synagogue letterhead with contact details.

A personal letter from the Aliyah applicant is also required

The letter should explain the convert’s motivation, study details, and synagogue participation.

Should be in English or Hebrew, can be typed, dated, and ink-signed.

Each adult applicant in a family should write their own personal letter.

Can additional letters be requested?

Yes, the Jewish Agency or Misrad HaPnim may request additional letters beyond the specified ones in the guide.

What if I don't have a Rabbi for the Letter Detailing Communal Participation?

In the absence of a Rabbi, three official members of the board of directors can sign this letter, clearly stating their names and positions.

What are the things I need to think about when starting to plan my Aliyah?

Many different things have to be thought off regarding your Aliyah process, the actual move and life in Israel. We created a timeline to give you a general overview.

How do I get all my furniture and belongings to Israel?

Depending on your original place of residence, several organizations help Olim to pack and move. Please contact us to get personalized guidance in this matter.

In addition to the option of organizations helping out, regular moving companies can help you as well.

Can I choose my exact date of Aliyah?

After finishing the entire Aliyah process and having received the visa in your passport, you can talk to the shaliach and together schedule your Aliyah date which must happen within 6 months. Please note that you cannot choose the date of the flight before the whole process is done.

My Aliyah date was set, what documents do I need to take with me?

You need to take all original documents with you in your hand luggage. See our guide explaining everything in detail.

What is the baggage allowance on the Aliyah flight?

There is no exact answer, since it depends on the specific flight, but usually Olim can travel with 2 checked suitcases (2 x 23kg) per person.

I will need a car. Is it worth it to ship my car from abroad or is it better to buy one in Israel?

In the first 3 years after Aliyah, Olim are entitled to import a car with a tax reduction. That shipment does not count as one of the 3 tax-free shipments that Olim are granted. However, importing a car is a complex process. Consider the involved costs and bureaucratic hassle before taking a decision:

- You will need a large container which can be costly.

- You need to arrange insurance for when the car is on the ship.

- You will probably have to pay a shipping agent who takes care of the paperwork and import licenses.

- When you are in Israel, you will have to convert your driver’s license sooner in order to get your car released. Depending on your driving experience, this might be just an administrative process of conversion, or it could involve additional lessons and re-testing.

- You have to be present at the port (either Ashdod or Haifa) to get your car released.

- Try to find out beforehand whether your car can be serviced in Israel, i.e. that the parts are available and that there are qualified mechanics for it. If your car is not available locally, it will get complicated.

Is there a limit to the amount of money an Oleh can bring into Israel?

An Oleh can bring any amount of money into Israel. However, sums of 50,000 NIS or more must be declared to customs according to Israeli law. This declaration is applicable to the total amount possessed by the reporting person or their family unit. (Note: These regulations also apply when taking money out of Israel.)

Why is it necessary to declare money at customs?

Declaring money at customs helps Israeli authorities monitor and prevent international money laundering attempts involving money entering or leaving the country. While Olim are usually not subject to questioning regarding declared funds, violating the legal obligation to declare money can result in the seizure of funds, criminal proceedings, and/or financial penalties.

What items need to be declared when bringing money into Israel?

The following items need to be declared:

- Mezuman (Cash)

- Check Banka’i (Bank check issued by a bank)

- Hamcha’at Nos’im (Travelers’ checks)

- N’yarot Erech (Banking securities/bearer securities)

- Shtarot S’chirim (Negotiable instruments)

- Cartisei Tashlum (Payment cards)

How can I declare money when entering Israel?

Follow these steps:

- Download and complete Declaration Form 84a.

- Submit the form to the customs official at the airport for review. You will receive a signed copy of the declaration.

- Mail Submission (if no customs official is available): If no customs official is present, send the completed form by Registered Mail with delivery confirmation within 72 hours of entering Israel.

Address for mailing:

המוקד הארצי לאיסור הלבנת הון

בנק ישראל 5, ירושלים

What should I do after submitting the declaration form?

Keep a copy of the submitted declaration form for your personal records and reference.

For more information on this topic, please check out or expanded guide here.

- ELIGIBILITY

- ALIYAH PROCESS

- PRACTICAL PLANNING

Am I eligible to make Aliyah?

In order to qualify for making Aliyah, you must meet at least one of the following conditions:

- you are Jewish (born to a Jewish mother or converted to Judaism by a Rabbinical Court recognized by the State of Israel), or

- you have a Jewish father or grandfather, or

- you are married to an eligible person, or

- you are a widow/er of a Jewish spouse

In addition, you must meet the following conditions:

- you do not to pose a risk to the national security of Israel

- you do not to pose a risk to the public health

Are you still in doubt? Click here to get more information.

I am Jewish, but my spouse is not. Can we both make Aliyah?

If you are not yet an Israeli citizen, yes.

I can't find proof about my Jewish roots, how can I prove that I am Jewish?

Look for the community or Rabbi who knew your parents and grandparents. You will need an official letter of eligibility from the Rabbi or official Jewish community to prove your eligibility. More information on the requirements for the letter can be found here.

Can I let my eligibility get checked by the Jewish Agency before gathering all the rest of the required documents?

Actually, you must have the Jewish Agency verify your eligibility first. Only then will you know which documents are required in your case.

How can I find out whether my conversion is recognized?

You must open an application file with the Jewish Agency and submit the conversion documents for verification.

Can I get an Israeli passport without making Aliyah?

If your parents are not Israelis and you were not born in Israel or have previously made Aliyah, the only way to obtain a passport is by making Aliyah.

I am Israeli, but I lived abroad for a while. Am I a Toshav Chozer?

Who qualifies for the status of Toshav Chozer and what you must do when returning to Israel, is explained in this guide.

I want to live in Israel but I'm not sure if I want to make Aliyah. Is there an alternative option?

If you are eligible for Aliyah but you are not sure if it is the best option for you, the Ministry of the Interior offers the possibility of temporary residence (A1 visa). See our guide here.

What are the requirements for obtaining the A1 residence visa in Israel?

If you are eligible for Aliyah, you are also eligible for the A1 visa.

Why should I make Aliyah?

Am Yisrael (the Jewish People) has the privilege to return to the Land of Israel under Jewish rule, after more than 2,000 years living in the Diaspora. Nowadays it’s pretty convenient to make Aliyah and move to Israel, compared to how it was in the beginning of the return to the land of Israel (starting some 140 years ago). It nevertheless requires good preparation and readiness to accept and adjust to a new reality. It’s not easy, but worthwhile. You and your family can spend the rest of your life in the Land of Israel. There are also other aspects and reasons that can be beneficial, such as education, Jewish communities, Jewish culture and business/professionally related considerations. It is important to really want to make Aliyah in order to overcome the first bumps after coming to Israel, we therefore recommend to have a strong ideological base for taking this step.

How do I make Aliyah?

Depending on your personal (family) situation, your background and the countries you (and your family members) lived in, you will need to gather a number of documents and get approval on your eligibility for Aliyah from the Jewish Agency for Israel. Click here to start your Aliyah, and here to understand more about the whole process and documents.

How do I begin my Aliyah process?

To begin your Aliyah process, you must personally call the Jewish Agency’s Global Center. You will need to answer some preliminary questions and will be informed about your eligibility and about how to proceed. You can find the phone number for your country here.

How long does the Aliyah process take?

The Aliyah process usually lasts between 6 months to 1 year, depending on many factors such as the applicant’s status and the length of time it takes to submit documents. You can find a rough timeline here.

Which documents do I need to make Aliyah?

Depending on your background, family situation and countries you have resided in you need different documents. Click here to learn more about the specific documents you need.

How do I get an apostille on my documents?

This differs per country. You can find more information on each country here.

How do I get my criminal background check?

This differs per country. You can find more information here.

How up to date must the documents be to be valid for the Aliyah application?

The passport is valid for the period specified therein. The police clearance must not be older than 6 months. The other documents (such as marriage, birth, death certificates, etc.) do not have an expiration date. As long as they are apostilled, they are valid. Note that the proof of Judaism might be valid for only one year, depending on the verification and requirements of the Jewish Agency and Misrad HaPnim.

I am divorced. Do I have to submit my marriage documents in addition to my divorce papers?

You need to submit both documents – the marriage certificate as well as the divorce certificate – each of them with apostille.

Which documents require a notarial translation and for which ones does a simple translation suffice?

Don’t translate any documents unless you are explicitly required to do so. In the majority of the cases the Jewish Agency will do the translations.

Do I need to pay?

The Jewish Agency charges a one-time fee for opening the application. The amount differs in each country and depends on the number of family members making Aliyah together.

I have a pet that I want to bring to Israel, how do I arrange this?

There are several things to arrange beforehand when making Aliyah with a pet. Your pet has to have a microchip and be vaccinated proven by a serological test. Besides that, there is some paperwork to do. You can find more details here.

I am already in Israel on a tourist visa, how can I make Aliyah?

You need to call the Jewish Agency or book an appointment at Misrad HaPnim in order to open a Shinui Ma’amad (שנוי מעמד) Change of Status file. You will be asked to present several documents and forms. Please keep in mind that you must have all the original documents with you to be able to have an interview.

How long does it take to make Aliyah from within Israel (shinui status)?

It usually takes about 3-6 months.

Is it quicker to make Aliyah from abroad or from within Israel (shinui status)?

Making Aliyah from within Israel (shinui status) is usually faster.

If a person begins the regular Aliyah process from abroad, can he continue and complete the process in Israel, i.e. change his status while in the country?

The process of making Aliyah from abroad is different from initiating Shinui Ma’amad status (Aliyah from within Israel). If you have begun the Aliyah process abroad, you will be able to use the already submitted documents. However, there are a number of additional forms to fill out. You must call the Jewish Agency and open a file for Shinui Ma’amad status. This process is explained in this guide.

What is the difference between the A1 visa and Aliyah?

The A1 visa is valid for 1 year and can be renewed annually. Having an A1 visa does not oblige you to serve in the army. Neither does it entitle you to receive the benefits of new immigrants (such as Sal Klita, discounts, ulpan, health insurance, etc.). Furthermore, the A1 visa holder does not receive an Israeli passport and must arrange private health insurance for his stay in Israel.

How can I apply for an A1 residency visa in Israel?

If you are abroad, contact the Jewish Agency’s Global Center. Find the phone number for your country here. If you are in Israel, make an appointment with the Ministry of the Interior in your city.

What documents are required to obtain the A1 residence visa?

See our guide for the entire list of documents you must submit.

Why are Ishurei Giyur - אישורי גיור - conversion letters, required for Aliyah?

Certain letters are essential for Aliyah after conversion to provide a comprehensive understanding of the conversion process and the applicant’s involvement in the Jewish community.

It is crucial to provide the list of required documents to the Rabbi, teacher, or community leaders who can assist in gathering the required letters.

Which letters are required, and what are their purposes?

- Letter Dealing with the Pre-Conversion from the Rabbi/Teacher or Community Leaders:

Provides details on the preparation for conversion.

Includes information about studies, activities, and interactions with the Rabbi.

Specifies the Beit Din details and mentions family members’ conversions if relevant. - Letter Detailing Communal Participation from the Rabbi/Teacher or Community Leaders:

Describes the applicant’s participation in the Jewish community.

Covers activities before, during, and after conversion.

Can be signed by three official members of the board of directors in the absence of a Rabbi. - Letter from External Beit Din (If relevant):

Clarifies the connection between the Beit Din and the applicant’s synagogue.

Explains the choice of the external Beit Din.

What are the requirements for the letters?

All letters must be dated and ink-signed.

Letters by Rabbis or teachers should be on synagogue letterhead with contact details.

A personal letter from the Aliyah applicant is also required

The letter should explain the convert’s motivation, study details, and synagogue participation.

Should be in English or Hebrew, can be typed, dated, and ink-signed.

Each adult applicant in a family should write their own personal letter.

Can additional letters be requested?

Yes, the Jewish Agency or Misrad HaPnim may request additional letters beyond the specified ones in the guide.

What if I don't have a Rabbi for the Letter Detailing Communal Participation?

In the absence of a Rabbi, three official members of the board of directors can sign this letter, clearly stating their names and positions.

What are the things I need to think about when starting to plan my Aliyah?

Many different things have to be thought off regarding your Aliyah process, the actual move and life in Israel. We created a timeline to give you a general overview.

How do I get all my furniture and belongings to Israel?

Depending on your original place of residence, several organizations help Olim to pack and move. Please contact us to get personalized guidance in this matter.

In addition to the option of organizations helping out, regular moving companies can help you as well.

Can I choose my exact date of Aliyah?

After finishing the entire Aliyah process and having received the visa in your passport, you can talk to the shaliach and together schedule your Aliyah date which must happen within 6 months. Please note that you cannot choose the date of the flight before the whole process is done.

My Aliyah date was set, what documents do I need to take with me?

You need to take all original documents with you in your hand luggage. See our guide explaining everything in detail.

What is the baggage allowance on the Aliyah flight?

There is no exact answer, since it depends on the specific flight, but usually Olim can travel with 2 checked suitcases (2 x 23kg) per person.

I will need a car. Is it worth it to ship my car from abroad or is it better to buy one in Israel?

In the first 3 years after Aliyah, Olim are entitled to import a car with a tax reduction. That shipment does not count as one of the 3 tax-free shipments that Olim are granted. However, importing a car is a complex process. Consider the involved costs and bureaucratic hassle before taking a decision:

- You will need a large container which can be costly.

- You need to arrange insurance for when the car is on the ship.

- You will probably have to pay a shipping agent who takes care of the paperwork and import licenses.

- When you are in Israel, you will have to convert your driver’s license sooner in order to get your car released. Depending on your driving experience, this might be just an administrative process of conversion, or it could involve additional lessons and re-testing.

- You have to be present at the port (either Ashdod or Haifa) to get your car released.

- Try to find out beforehand whether your car can be serviced in Israel, i.e. that the parts are available and that there are qualified mechanics for it. If your car is not available locally, it will get complicated.

Is there a limit to the amount of money an Oleh can bring into Israel?

An Oleh can bring any amount of money into Israel. However, sums of 50,000 NIS or more must be declared to customs according to Israeli law. This declaration is applicable to the total amount possessed by the reporting person or their family unit. (Note: These regulations also apply when taking money out of Israel.)

Why is it necessary to declare money at customs?

Declaring money at customs helps Israeli authorities monitor and prevent international money laundering attempts involving money entering or leaving the country. While Olim are usually not subject to questioning regarding declared funds, violating the legal obligation to declare money can result in the seizure of funds, criminal proceedings, and/or financial penalties.

What items need to be declared when bringing money into Israel?

The following items need to be declared:

- Mezuman (Cash)

- Check Banka’i (Bank check issued by a bank)

- Hamcha’at Nos’im (Travelers’ checks)

- N’yarot Erech (Banking securities/bearer securities)

- Shtarot S’chirim (Negotiable instruments)

- Cartisei Tashlum (Payment cards)

How can I declare money when entering Israel?

Follow these steps:

- Download and complete Declaration Form 84a.

- Submit the form to the customs official at the airport for review. You will receive a signed copy of the declaration.

- Mail Submission (if no customs official is available): If no customs official is present, send the completed form by Registered Mail with delivery confirmation within 72 hours of entering Israel.

Address for mailing:

המוקד הארצי לאיסור הלבנת הון

בנק ישראל 5, ירושלים

What should I do after submitting the declaration form?

Keep a copy of the submitted declaration form for your personal records and reference.

For more information on this topic, please check out or expanded guide here.

- FIRST STEPS IN ISRAEL

- BENEFITS

- EDUCATION

- RIGHTS & OBLIGATIONS

- HOUSING

- HEALTH

- FINANCES

- OUR SERVICE

- EMPLOYMENT

What are the first things I need to take care of after arriving to Israel?

There are a number of things you need to do. First of all you should open a bank account (see our guide here). It is important to have an active bank account in order to be able to continue with the next steps, such as going to Misrad HaKlita (see our guide here), registering at an HMO (see our guide here), choosing an Ulpan or registering your children for school (see our guide here). An overview of your first steps in Israel can be found here.

I made Aliyah on my own. Are there any programs where I can settle temporarily and receive help in integrating?

There are Aliyah programs for young Olim (age 18-35) such as Hebrew language courses on Kibbutzim or in cities, preparation for college or graduate studies, guidance for employment and preparation for recruitment into the IDF. To get an idea of programs and costs, click here.

Which health insurance (Kupat Cholim/HMO) should I choose?

The health insurance that best suits you depends on your personal needs, the needs of your household, the place of residence and other factors. We created a guide with some basic information. If you still need help, please contact us.

I don't speak any Hebrew. How do I manage at the beginning?

Many people speak English (and sometimes other languages as well). Nevertheless we advise you to take advantage of your right for a free government sponsored Ulpan (Hebrew course).

How do I convert my driver's license?

If you had a valid driver’s license for at least 5 years immediately preceding your Aliyah, you can convert your license without taking any lessons or tests. In order to convert your foreign driver’s license to an Israeli one, follow the steps explained in this guide.

Please note that your foreign driver’s license is valid in Israel for only one year. You should therefore convert your license before that first year passes.

How do I renew my driver's license?

About a month before your current license expires you should receive a payment request voucher in the mail. Check out our Guide here for more detailed information.

How often do you need to renew your driver's license in Israel?

As of October 1, 2021, a driver’s license issued for private vehicles, motorcycles, and commercial vehicles up to 12 tons (category A and B) will be valid until age 70 (instead of 10 years). From 70, you’ll need to renew your license when you’re 75 and 80. From 80 you’ll need to renew it every two years.

What are the payment options for renewing my driver's license?

Payment options include:

- Online digital options on the official government portal here or the Misrad HaTachbura (Ministry of Transportation) site here. A temporary license will be emailed to you immediately, and your permanent license will be mailed to you within 30 days.

- Via digital payment apps like Apple Pay or Google Pay here, and Max here. A temporary license will be emailed to you, and your permanent license will be mailed to you within 30 days.

- Bank transfer.

- Rishiomat (self-service computer station), located in Misrad HaRishui (Licensing) offices and some Superpharm pharmacy branches.

- Phone by calling *5678 or 03-5086905.

- Post Office.

How do I get my picture taken for my driver's license?

If your payment request voucher indicates that you need a photo for your license, you can get your picture taken at a photo station here. You must pay for your license first and bring your temporary driver’s license to the photo station.

Do I need to undergo any medical checkups to renew my driver's license in Israel?

If you are a professional driver 60+, including taxi drivers, bus drivers, and heavy equipment operators, you are required to undergo health checkups. The results of the eye checkup must be signed by an ophthalmologist or optometrist here. Regular drivers are required to have medical checkups and eye tests from age 70.

How much does it cost to obtain a driver's license in Israel?

The cost of obtaining a driver’s license in Israel depends on your age and the type of license you need. Fees are subject to change.

What are my benefits?

The benefits vary based on the candidate’s status, the number of family members making Aliyah together and their age. In general, olim chadashim receive the so-called Sal Klita (financial assistance), health insurance for six months, Hebrew ulpan, and various tax benefits. A chronological overview of the benefits including the period of time that they are valid, can be found here.

How do I receive my benefits?

In order to receive your benefits, you first need to have an active bank account. Our guide on how to open a bank account can be found here. Once your bank account is active, you can go to Misrad HaKlita where you will get information about your benefits and status as an Oleh Chadash. After your first visit at Misrad HaKlita you will start receiving the monthly Sal Klita payments.

Am I eligible for financial assistance (Sal Klita)?

You are most probably eligible for the Sal Klita if you:

- spent less than 24 (consecutive or cumulative) months in Israel within 3 years prior to your Aliyah

- spent less than 3 years in Israel within 7 years prior to your Aliyah

A Katin Chozer gets the Sal Klita only if he spent less than 1 year in Israel prior to the Aliyah (exceptions might be made for recognized study programs).

For how long do I get financial assistance (Sal Klita)?

If you are eligible to get Sal Klita, a monthly payment will be transferred to your Israeli bank account for 6 months.

How do I get financial assistance (Sal Klita)?

The Sal Klita is paid in 6 monthly payments to your Israeli bank account. Olim Chadashim and Ezrachim Olim will get their first portion partly as an initial cash payment upon their arrival at the airport, partly wired to their Israeli bank account. A Katin Chozer or someone who received shinui status won’t receive the first payment at the airport, they get all the payments via bank transfer.

How much money do I get as financial assistance (Sal Klita)?

During the first 6 months, a certain amount of money will be transferred directly to your Israeli bank account. The amount varies based on your age and the number of family members. In order to get an indication, you can calculate the amount you will probably get here. If you are not an Oleh Chadash, but possess a special status (e.g. Ezrach Chozer, Katin Chozer, etc.) your benefits might differ. You can find more information on your eligibility for benefits here.

How do I get a free flight ticket when making Aliyah?

Do not book and pay the flight on your own, since you won’t get a refund. Speak to your shaliach or Jewish Agency office instead and they will arrange it for you.

Where can I get an Israeli SIM card?

Upon your arrival at the airport, you will get a temporary Israeli SIM card with free minutes to call and internet data allowance. This gives you enough time to choose your preferred phone company and plan.

For how long is health care free of charge?

If you don’t have an income, you will get the basic health insurance for free during the first 6 months after Aliyah. If you are unemployed after the first 6 months and receive income support from Misrad HaKlita (called Dmei Kiyum), you can get free health care for an additional 6 months. For this you must notify Bituach Leumi.

Do new Olim have to pay taxes in Israel?

Yes, but they do get a significant discount. See more details about benefits in general here.

What are my benefits with regards to income tax?

There is a tax discount on income earned in Israel in the first 3.5-4.5 years after Aliyah. In Israel the tax reduction is determined by a point system.

The discount changes over time as follows:

Olim who came on Aliyah after 1.1.2022 receive tax discounts for 4.5 years from the date of Aliyah:

- First 1 year: 1 point

- 1 – 2.5 years: 3 points

- 2.5 – 3.5 years: 2 points

- 3.5 – 4.5 years: 1 point

Olim who came on Aliyah before 1.1.2022 receive tax discounts for 3.5 years from the date of Aliyah:

- First 1.5 years: 3 points

- 1.5 – 2.5 years: 2 points

- 2.5 – 3.5 years: 1 point

What is the 10 year tax exemption for new Olim?

New Olim or returning Israelis who have resided abroad for at least 10 full years (and for whom the center of life was abroad during those years), receive 10 years of tax concessions and benefits. For a period of 10 years, eligible new Olim and returning residents are exempt from tax on all income that originates outside Israel. The exemption covers all passive income, such as interest, dividends, allowances, royalties and rent from properties. Income, whether derived from the realization of assets and investments abroad or from current passive income abroad, is tax-exempt. See also here.

Do I have to pay taxes on my pension from abroad after making Aliyah?

Olim are exempt from declaring and paying taxes on their pension in the first 10 years after their Aliyah. See also here.

I get an income from abroad. Do I get a tax discount on it?

If you earn a passive income abroad, you are probably eligible for tax breaks within the first 10 years of your Aliyah. There might be restrictions if you have lived in Israel prior to Aliyah.

I want to buy property. Are there any tax benefits?

In order to be eligible to receive the benefit of reduced property purchase tax, you must meet the following conditions:

- The purchase must be completed within 10 years after Aliyah.

- You must use the property personally, i.e. as your home or as your business.

- The benefit can be used only once for a residential property and once for a commercial property.

I want to buy property with a mortgage. Is there a discount?

In the first 15 years, you might be eligible for low interest rates when buying your first own property in Israel. If your spouse owns or owned a property in Israel, you won’t be granted the discount.

It is in any case recommended to check the interest rates, since some places might give even better rates regardless of the Aliyah benefit.

What are my benefits with regards to rental assistance?

Toggle ContentStarting from the 8th month of your Aliyah, you will get rental assistance for up to 5 years from the date of your Aliyah. The amount depends on your family status and the number of years you have resided in Israel. More information and a table of amounts can be found here (Hebrew only).

I want to send my child to daycare. Can I get a reduction?

You might be entitled to a reduction in daycare costs for Maon or Mishpachton in the first 2 years. The Maon or Mishpachton has to be recognized by the Ministry of Economy (Tamat). To check if your Maon or Mishpachton is recognized, click here. In order to receive the benefit, each parent must fulfill one of the following criteria:

- Learning in an Ulpan (minimum 24 weekly hours each)

- Being registered with Misrad HaKlita or Sherut HaTaasuka as unemployed and seeking a job

Besides the discount for Olim, an additional reduction can be applied for based on the parents’ income.

I want to study at the university. Do I get tuition benefits?

Based on your age, tuition assistance is available for different study programs if the institution is recognized by the Student Authority:

- Up to age 23: Mechina (preparatory year course)

- Up to age 27: BA

- Up to age 30: MA

- MA students might get up to 1 year of Hashlamot (prerequisite classes) paid.

In order to receive the benefit, you must start your studies within the first 3 years after Aliyah. The army and Sherut Leumi are not counted in the 3 years.

Who is eligible for Ulpan benefits?

Olim (new immigrants) within 10 years of their Aliyah (immigration) for either a government-sponsored or private Ulpan.

Age requirement for the voucher program: You must be 17 years or older at the time of Aliyah.

Olim who have previously studied in Ulpan using a voucher and wish to continue their Hebrew studies in “Ulpan Aleph” in a Ministry of Education Ulpan.

Olim who completed Ulpan Aleph of the Ministry of Education and attended all classes, and now want to continue their Hebrew studies using the voucher program in a private Ulpan.

Is financial assistance available for Ulpan courses?

Yes, financial aid is available but subject to certain conditions:

The financial aid amount will not exceed 7,500 NIS or the actual course cost, whichever is lower.

You may be eligible for a transportation subsidy; please inquire with your Klita counselor.

Olim enrolled in an Ulpan who are not receiving Sal Klita Integration basket payments may be eligible for a living allowance during their study period.

Please note that Olim who do not utilize their Ulpan benefit during their first year of Aliyah will not be eligible for living allowance and transportation subsidies provided by Sal Klita if they register for an Ulpan later on.

For more detailed information on how to receive financial assistance, you can view this link.

How long is the benefit for a Hebrew Ulpan valid?

The first Ulpan must be attended within 18 months of your Aliyah. In order to receive full reimbursement, you must attend at least 80% of the lessons. To get a certificate at the end of the course, you must take the final exam. There is an option for a second Ulpan within 10 years of your Aliyah, only one of the two can be a private Ulpan though. For more details click here and/or contact us. Children in grades 1 through 12 can receive additional Hebrew lessons in the first year of Aliyah.

I need a temporary residence when I arrive in Israel. Am I eligible for Merkaz Klita?

If you are younger than 55, you might be eligible. If you want an absorption in a Merkaz Klita, you need to request it early in the Aliyah process, since the spots are limited. You can do that when filling out the questionnaires from the Aliyah portal.

I am over 55 years old. Are there any absorption options for me?

There are no absorption programs provided by the Jewish Agency for that age group. But you can get in touch with us for other options tailored to your personal situation.

What are the conditions of the customs benefits?

You can bring 3 shipments of appliances and household goods tax-free to Israel. This benefit applies up to 3 years after Aliyah. Extensions are granted in exceptional cases, such as military service, full-time study or a 6 months absence from Israel. If you are a former A1 temporary resident, you first need to open a file with the Customs Authority in order to clarify your status. Don’t bring in any shipments before you receive that clarification.

Who is eligible to purchase a new car at a reduced tax rate in Israel?

Olim (עולים), new immigrants, are eligible to purchase new cars at a reduced tax rate within three years after making Aliyah.

How is the tax cost of a new car for Olim calculated?

50% Meches (מכס), Customs Tax, on all vehicles + 17% VAT (Value Added Tax).

Here’s a sample calculation:

- If the car is worth: 100,000 NIS, Meches on the car: 100,000 NIS x 50% = 50,000 NIS

Car value + Meches = 150,000 NIS - VAT payment: 150,000 x 17% = 25,000 NIS

- Total tax payment: 50,000 NIS + 25,000 NIS = 75,000 NIS

What are the steps to buy a new car with Zechuyot?

Here are the steps to buy a new car with Zechuyot:

- Find a car dealer and visit their dealership to choose the vehicle you want. Negotiate with the dealer directly for potential discounts or extras.

- Prepare the required documents including:

- a copy of your Teudat Oleh (תעודת עולה), New Immigrants Aliyah booklet.

- a copy of your Israeli Rishyon Nehiga (רישיון נהיגה), Driver’s License (acquired via the conversion of a foreign driver’s license).

- original driver’s license from your country of origin

- foreign passport with Aliyah visa, and Teudat Zehut.

- The car dealer will send the necessary documentation to Meches (מכס), the Customs Authority. Within 10 days to three weeks, your car should be released to you with the reduced tax benefit.

Can I buy a hybrid or electric vehicle (EV) with the Olim discount?

No, Olim buying a new hybrid or electric car do not receive the Olim discount, as the tax rate for these cars is already lower than the Olim benefit tax rate.

How can Olim sell their car within four years of purchase without penalties?

Olim can sell their car to another Oleh who still has rights to purchase a car with reduced taxes. This is called Passport to Passport. The seller and buyer must visit the local office of Meches to determine the car’s final value and any outstanding taxes owed.

Can I use my Oleh benefits when purchasing a second-hand car privately?

No, you cannot use your Oleh benefits when purchasing a second-hand car privately. However, you can still use your benefits to purchase an additional new car or a passport-to-passport car within three years of Aliyah.

What should I do if I buy a car without Zechuyot?

If you buy a car without your Zechuyot, you need to go with the seller and the Rishyon Rechev (רשיון רכב), Car registration certificate, to any Snif Doar (סניף דואר), Post Office branch, and pay 187 NIS to transfer ownership. Sometimes the seller may split the fee with you.

What are the restrictions when selling a car purchased with Zechuyot?

Selling the car within four years of purchase requires paying back the tax reduction received at the time of purchase. After four years, this restriction is automatically lifted. To calculate or pay off the remaining taxes before the four-year mark, one can fill out an online form or email yim@taxes.gov.il. Make sure to receive confirmation that the restriction has been lifted before transferring ownership of the car or allowing other family members to drive it.

Who is allowed to drive a car purchased with Zechuyot?

Only the person who used their Zechuyot to purchase the car and their spouse are allowed to drive the car.

Can children of Olim drive a car purchased with Zechuyot?

Children of Olim who wish to drive a car purchased with Zechuyot must have the same address as their parents on the Sefach (ספח), Information attachment, of their Teudat Zehut. They require written permission from Meches, which can be obtained by visiting the nearest Meches office with a written request, a copy of their driver’s license, a written request from the car’s owner (parent), their Teudat Zehut, and the car’s registration certificate. The approval is granted for one year and can be extended.

I left Israel after having made Aliyah. Do I still have benefits when I return?

If you left Israel within the first 10 years after your Aliyah, you probably have some benefits left. You can check this with Misrad HaKlita (once you are back in Israel) or by calling and opening a file for Arachat Zakaut with the Jewish Agency.

I am already in Israel and want to make Aliyah from here (shinui status). What benefits do I lose?

The benefits vary based on your status and other factors. If you make Aliyah from within Israel, you will not receive the Aliyah flight ticket, the free SIM card and the taxi from the airport. An overview of the benefits you can find here. Please note that only Misrad HaKlita can give advance ruling on your personal benefits.

I am a returning resident (Toshav Chozer). What are my benefits?

We advise you to first check here if you meet the criteria of a Toshav Chozer. In order to determine what benefits you are entitled to, you must apply for your first year of the so-called adaption benefits by filling out this form. Please be aware that an Israeli bank account is required in order to receive financial assistance.

Are my benefits affected if I stay in Israel on an A1 visa and want to make Aliyah at a later stage?

You start to lose some of the Aliyah benefits if you stay in Israel for:

- more than 2 cumulative years in the last 3 years, or

- more than 3 years in the last 7 years

Who is eligible for tax benefits as an Oleh in Israel?

- Oleh Chadash – עולה חדש – Eligible according to the Law of Return

- Ezrach Oleh – אזרח עולה – Born abroad to an Israeli parent

- Katin Chozer – קטין חוזר – Returning Minor

- Toshav Chozer – תושב חוזר – Returning Resident (limited Customs benefits only)

What are the benefits available to Oleh regarding tax exemptions?

- Oleh can import household items with no taxes, limited to three shipments within three years, including shipments by boat, plane, post office, or items brought into Israel in person after the Aliyah flight.

- Reduced taxes on purchasing a new car/motorcycle from a dealer.

What items are eligible for tax exemptions?

- Personal belongings such as clothing, footwear, personal toiletries, and limited quantities of alcohol, cosmetics, and tobacco.

- Other items brought in for personal use or as gifts, valued at $200 USD or less per entrant aged 2 and up.

- Certain types of food up to 3 kilograms with limitations.

- The exemption is limited per person and cannot be combined to exempt items valued over $200 USD.

How are household items treated for tax purposes?

- Household items imported within three years from the Aliyah date are tax-free but if brought in during a trip must be declared and processed through the Red customs lane at the airport.

- Household goods do not include items for permanent installation such as plumbing materials or building materials.

Are there any restrictions on appliances?

- Each family may import up to 3 televisions and 3 computers.

- For other appliances, electronics, and major furniture items, only one item of each category may be imported.

What are the conditions for importing hand-held tools?

Tools for professional needs as determined by customs officials may be imported tax-free, provided their total value does not exceed $1,650 upon purchase.

How are items imported by mail treated for tax purposes?

- Postal packages containing household items count towards the three shipments entitled to an Oleh.

- Packages containing only clothing and footwear are exempt from tax under specific conditions, such as arrival within 30 days before entry.

What are the regulations regarding importing motor vehicles?

For detailed information on importing motor vehichles, please refer to our guide here provided.

Does Israel have free education?

Education and special education for children is free in Israel by the law of “Chok Chinuch Chova” (the law for mandatory education). This law applies to the ages 3-18. Other types of education do charge tuition fees. In some cases these might be (partially) subsidized. You can find some basic information on the educational system here.

Do Olim get free university education/courses?

Specific types of Olim can get discounted, subsidized and/or free courses. Your Klita counselor at Misrad Haklita can give you the precise answers about this, since these depend on your age, status as Oleh and some other factors. A general overview of your benefits can be found here.

What are the types of Ulpan available?

There are two types:

Government-Sponsored Ulpan: Offered by the Ministry of Education and available throughout the country. Eligibility is typically determined by the address on your Teudat Zehut (ID card).

Private, Subsidized Ulpan: Run by various private providers, both in-person and online, and can be accessed using vouchers issued by the Ministry of Aliyah and Integration (Misrad HaKlita).

Some private ulpans are fully subsidized, others are not. You need to check this out with the ulpan itself or contact us.

Which Ulpan should I go to?

This really depends on your level of Hebrew, age, family situation and the place of residence, whether you want to go to a boarding program or a morning/afternoon/evening program etc. A guide for ulpan study can be found here. Contact us for personal advice regarding your specific circumstances.

How do I register for an Ulpan?

You can register by either:

Contacting your Klita counselor at your local branch of the Misrad HaKlita to receive a referral for Ulpan.

Applying online here.

If multiple Ulpan programs are available, you may want to visit them to gather more information before registering.

I am making Aliyah with school -aged children. How do I decide where to send them?

Each country has its own educational system. Choosing the right school depends on many factors, such as the age of your children, your religious level of observance, their language skills and more. You can find an overview of the Israeli educational frameworks here.

What are the requirements for converting my occupational therapy license in Israel?

Ensure that your studies, including an internship, are approved by the Misrad HaBriut (משרד הבריאות) Ministry of Health (MOH) in Israel.

What documents do I need to prepare for the license conversion process?

Obtain the necessary documents for the process, including two passport photos, application form, questionnaire for healthcare professionals, photocopies of an Israeli identity card, final diploma in occupational therapy or certification of completion, valid license to practice, official confirmation of study dates, official certification of completing a 1,000-hour internship (or proof of at least one year of work as an OT), and professional certificate of good standing.

How do I verify the required documents?

You can choose one of the following options: verification with an apostille, visit/send the documents to an Israeli notary for notarization, or obtain an Imut He’etek (verified copy) of the document at the Israeli consulate.

How many copies of each document should I submit?

You need to submit two copies of each document: one verified copy along with an additional photocopy of the original document. Retain the originals and a photocopy of the verified document for yourself.

Are online degrees recognized for the license conversion process?

No, currently online degrees are not recognized by the Israeli Ministry.

What should I keep in mind regarding the validity of the documents?

Some documents listed are valid for only one year from the issuing date. Ensure timely submission of your Teudat Zehut (תעודת זהות) Israeli ID card to avoid the need for re-issued documents.

How often is the licensing exam given?

Once your documents are approved, you must pass a licensing exam, which is available twice a year and offered in various languages.

Can I complete the license conversion process before immigrating to Israel (Aliyah)?

Yes, you can complete all the steps before Aliyah to expedite the process. Your file will be ready, pending completion of Aliyah.

What should I do after completing Aliyah?

If your documents are approved and you pass the exam, you need to send your new Teudat Zehut upon completing Aliyah, and your license will be mailed to your home address.

Can I get reimbursed for notarization and translation expenses?

If you are below the Israeli retirement age, you may be entitled to reimbursement from the Absorption Ministry for expenses incurred in Israel (up to 4000 NIS). The reimbursement process can be initiated only after completing Aliyah. Take your original receipts to your local office of Misrad HaKlita and submit them for processing.

Is there a central number where I can get more information or have my questions answered?

Misrad Habriut now offers a new customer call center to answer questions about licensing for healthcare professionals. In Israel call *5400, Sunday through Thursday, 8:00 – 18:00, and Fridays from 8:00 – 13:00.

Why might my child need a developmental or educational assessment?

Assessments, known as Ivchunim – אבחונים- Developmental & Educational Assessments, may be initiated due to concerns about a child’s cognitive functioning, learning, attention, emotional well-being, or behavior at school or home. They provide insights into various aspects, including abstract thinking, language skills, memory, attention, motor skills, academic skills, and emotional factors.

What information is covered in a broad-based assessment?

Broad-based assessments examine cognitive, learning, and psychological strengths and weaknesses. They include aspects such as abstract thinking, language skills, memory, attention, processing speed, fine motor skills, academic skills (reading, writing, mathematics), and executive function skills (attention, planning, organization). Psychological and emotional factors are also considered.

Why is the language of evaluation important for Olim children?

Olim children should be tested in their stronger language with bilingual components, including Hebrew reading, writing, and language skills. Bilingual assessments, conducted by highly qualified psychologists, ensure accurate representation of a child’s abilities, especially for primarily non-Hebrew speaking children or those with complex developmental histories.

What are the different types of assessments available?

In addition to regular Ivchunim, there are:

- Ivchun Didacti (אבחון דידקטי) didactic educational assessment, focusing on specific academic skills.

- Psychological evaluations used to assess emotional states, often including an IQ test.

- Developmental assessments are for preschoolers and are often obtained through pre-kindergartens or municipal services. Private broad-based developmental assessments by bilingual psychologists are recommended for non-Hebrew speaking children.

How do assessments benefit children at different educational stages?

Assessments at different stages provide recommendations for placement, remedial services, accommodations, therapeutic interventions, and potential transfer to special education. For high school preparation (Bagrut), assessments are crucial for test accommodations, including extra time, reading assistance, and more.

Why might my child's assessment need updating?

Children face increasing cognitive and academic demands with age, requiring periodic reassessments. Some conditions may only reveal their full impact later, necessitating updated interventions and accommodations. While the Israeli Ministry of Education considers assessments valid for 5 years, psychologists often recommend reassessment every 3 years, especially for complex cases.

How can I prepare my child for assessment?

Ensure your child is well-rested, not hungry, and comfortable asking for breaks. Discuss any relevant medication with the examiner and inform them of any physical or emotional conditions on the testing day. Adequate preparation helps create a comfortable testing experience, yielding reliable results.

What assistance is available for Olim children in the education system?

Resources vary by school, and it’s advisable to check with the school guidance counselor regarding test accommodations and professional assistance. Advocacy may be necessary in schools unfamiliar with Olim children, and discussing experiences with other Olim parents can provide valuable insights.

Am I obligated to remain in Israel if I make Aliyah?

Olim are not required to remain in Israel for a minimum period of time, but their departure might result in the loss and reduction of some benefits. Especially if they leave Israel within the first year of Aliyah, they might have to pay back benefits which were received.

Can I leave Israel within the first year of Aliyah?

There is no prohibition of leaving Israel or a mandatory minimum stay in Israel. However, consider the following consequences when leaving Israel:

- If you leave Israel in the first 6 months after Aliyah, the Sal-Klita-payments will automatically be frozen upon your departure from Israel and unfrozen as long as you return within the first year of your Aliyah. If however your return exceeds one year after your Aliyah date, you won’t get the Sal Klita-payments anymore and might lose other benefits as well.

- If you leave Israel within the first year of your Aliyah, there is no issue with Bituach Leumi because your national insurance is part of Misrad HaKlita in the first year. If you want to leave Israel after the first year for a longer period of time, check the consequences with Bituach Leumi.

Can I keep my citizenship(s) when making Aliyah?

This depends on the country you have your citizenship(s) from. Some countries don’t allow dual citizenships, while others allow even more than two. Israel does allow multiple citizenships. Thus, you have to check the laws of your country of origin. If you need help with this, don’t hesitate to contact us.

What can I do in order not to lose my citizenship(s) when making Aliyah if the country I make Aliyah from doesn't allow dual/multiple citizenship?

The Israeli authorities are aware of the problem that some countries don’t allow dual/multiple citizenship and provide a solution by signing the “waiver to renounce Israeli Citizenship” (Tofes Arli). In practice it means that you don’t get an Israeli passport, but will get a Teudat Zehut and will have all the rights and obligations of an Israeli citizen and Oleh Chadash (besides that you won’t be able to vote in national elections, only in local ones). You do not lose any Aliyah benefits when signing the waiver.

If I apply for Shinui Ma’amad (שינוי מעמד) status, can I work in Israel?

No, until your Aliyah is finalized you are not allowed to work. However, when applying for the change in status at Misrad HaPnim you can also apply for a temporary work permit.

If I am retired when making Aliyah, do I get a pension from Israel?

Whether or not you are entitled to an Old-Age pension in Israel depends on several factors. More information can be found here.

Will I get my pension from my country of origin in Israel as well?

According to the law of most European countries, you can also receive an old-age pension while living in Israel. Check the details with your country of origin or contact us.

Who is obligated to serve in Tzahal (צה”ל ) the Israel Defense Forces (IDF)?

It depends. According to Israeli law, all Israeli citizens between the ages of 18-21 are required to be enlisted into the IDF. If you fall within this age group, are healthy, and are unmarried, then you may be drafted.

If you are between 22-27 years old, you are exempt from serving but can choose to volunteer for service. Olim (immigrants) who are 28 years old and above do not need to serve and cannot volunteer for service.

Important Note: There are some exceptions to the rule above. Olim may be drafted despite being officially over-age, for example, if they received a deferment or postponed their service until finishing their academic studies. It’s also possible that people who made Aliyah after having an A1 Visa for a few years will be drafted despite being over-age.

To verify your obligation, contact the IDF Meitav Overseas Recruitment Department for instructions, via WhatsApp at +972-52-945-8579, email joinidf@mail.idf.il, or phone at +972-3-7387080

What factors determine whether someone will be drafted?

Various factors such as medical health, physical fitness, and marital status are taken into account when determining whether someone will be drafted.

What is the duration of mandatory service?

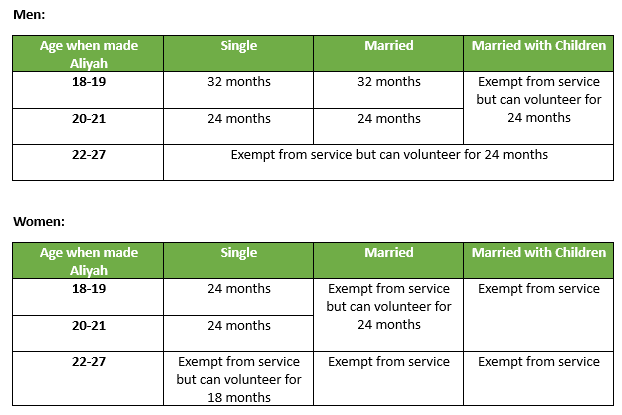

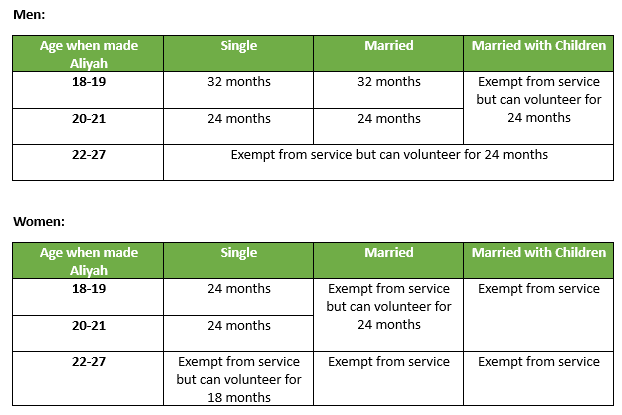

The duration of mandatory service depends on the age at the time of Aliyah (immigration to Israel) and personal status. There is a chart available for reference, specifying the duration based on different factors.

Are there any exceptions or extensions to the mandatory service?

Yes, there are exceptions and extensions. Women in certain roles, such as combat roles, may be required to serve for 32 months. Additionally, there are circumstances where individuals who have postponed their service, received deferments, or made Aliyah after having an A1 visa for a few years may still be drafted for compulsory service, even if they are over 21.

When do Olim (עולים) immigrants begin their service?

Olim are given 1 year to adapt to living in Israel before being drafted into the IDF. However, some Olim choose to enlist before the completion of this 1-year period.

How can one enlist in the IDF within the first year of Aliyah?

If someone wishes to enlist within the first year of Aliyah, they can contact the IDF Meitav Overseas Recruitment Department for instructions. They can reach out via WhatsApp at +972-52-945-8579, email at joinidf@mail.idf.il, or phone at +972-3-7387080.

What is a Tzav Rishon (צו ראשון)?

A Tzav Rishon is the first draft notice individuals receive from the Israel Defense Forces (IDF), officially making them candidates for the IDF.

How do Olim Chadashim typically receive a Tzav Rishon?

Olim Chadashim usually receive a Tzav Rishon by mail at their home address.

What does a Tzav Rishon include?

A Tzav Rishon includes the time and date for reporting to the Lishkat HaGiyus (לשכת הגיוס) IDF Recruitment Office, a personal code for the IDF website, an information brochure, a medical questionnaire to be completed by a doctor, and public transportation vouchers for free travel to the designated recruitment office.

What are the next steps after receiving a Tzav Rishon?

Make an appointment with your family doctor through your Kupat Cholim (HMO) and bring the forms received from the IDF. The doctor will complete and sign the She’elon Refui Tzav Rishon (שאלון רפואי צו ראשון)medical questionnaire.

The doctor will provide a Hafnaya (הפניה) referral for a urine test.

Print and digitally save the medical questionnaire and urine test results.

Make an appointment with an Rofeh Einayim (רופא עיניים) eye doctor through your Kupat Cholim and bring the appropriate IDF forms. The doctor will complete the necessary section.

Log into your personal zone on the IDF website using the provided password and fill in the required information, including medical details (in addition to the physical form from your doctor).

Upload digital versions of all the above documents to your personal zone on the IDF website.

Keep all paper documents organized and bring them physically when reporting to the IDF recruitment office.

Is there a recommended deadline for uploading documents on the IDF website?

It is advised to upload all the required documents no later than 2 weeks before the appearance date at the IDF recruitment office.

Do religious women making Aliyah need to go to the army?

Religious women can get a P’tor (פטור) exemption from army service. Until the P’tor from the army is actually in your hands, you must follow all the instructions of the army. Married women are automatically exempt from IDF service.

I'm planning Aliyah, will I have to serve in the IDF?

It depends. According to Israeli law, all Israeli citizens between the ages of 18-21 are required to be enlisted into the IDF. If you fall within this age group, are healthy, and are unmarried, then you may be drafted.

If you are between 22-27 years old, you are exempt from serving but can choose to volunteer for service. Olim (immigrants) who are 28 years old and above do not need to serve and cannot volunteer for service.

Important Note: There are some exceptions to the rule above. Olim may be drafted despite being officially overage, for example, if they received a deferment or postponed their service until finishing their academic studies. It’s also possible that people who made Aliyah after having an A1 Visa for a few years will be drafted despite being overage.

I’m an Oleh, between 18-21 years old, how long will I need to serve?

In general, the duration of service for Olim in this age group (as of June 2020) depends on your age at the time of Aliyah, your personal status, and your state of health. See the following chart for details.

I’m over 21 years old, do I need to serve?

In general, Olim who are between 22-27 years old upon arrival in Israel are exempt from service, but they can choose to volunteer for 18 months. Olim who are 28 years old and above are completely exempt from service and cannot volunteer to serve.

The IDF refers to me as a “Malshab,” what does this mean?

This is IDF lingo for a candidate that is draftable to the IDF by Israeli law.

I have a medical condition, do I need to serve? Will the IDF draft me?

It depends. Certain pre-existing medical conditions may lead to service exemption. The IDF decides whether to draft you based on your preliminary health screening at your Tzav Rishon ( צו ראשון) First Draft Notice. At this time, you will receive a numeric value referred to as your “profile number.” A service candidate with a numeric profile value of 21 or 24 is dismissed from service. Learn more about the IDF profile number.

I don’t know Hebrew / my Hebrew is not good enough, what should I do?

The IDF will give you a Hebrew test during your Tzav Rishon. Depending on your results, you may be sent to a 3-month Hebrew Ulpan course at Michva Alon base (the IDF’s education division base).

It is advisable to study well in the Ulpan as this is an important key to successful integration into the IDF – and into Israeli society at large. Hebrew can open doors for you, both professionally and personally, within the IDF and outside of it, so it’s worth the effort to learn the language as best you can before your active service.

Is the Hebrew Ulpan at Michva Alon base considered part of my military service or do I attend it before enlisting?

Yes, the IDF Ulpan begins after your official drafting. You will go to the Ulpan in uniform, and the 3-month Ulpan course is considered part of your official service.

I have just made Aliyah and am within the compulsory age of enlisting. Will I need to start my IDF service right away?

No. The IDF understands that new Olim need some time to adapt to living in Israel. Therefore, Olim are only officially required to enlist 1 year after their Aliyah date.

I don’t want to wait a full year before starting my IDF service, can I enlist sooner?

Yes, you can enlist before your 1-year adaptation period is over. However, it’s good to know that the IDF runs Ulpan courses only 3 times a year: July-August, November-December, and March-April (the IDF decides on the exact dates).

If you wish to learn Hebrew in the army Ulpan – and we suggest you do – then try to get your draft date arranged accordingly.

If you wish to enlist within your first year of Aliya, contact the IDF Meitav Overseas Recruitment Department for instructions, via WhatsApp at +972-52-945-8579, email joinidf@mail.idf.il, or phone at +972-3-7387080.

I’m pregnant, do I have to serve in the IDF?

No, pregnant women and mothers of children are exempt from serving in the IDF.

Everyone keeps talking about IDF profile numbers. What are these numbers?

The (medical) profile is a number assigned to each potential recruit that reflects their physical and mental fitness for serving in the IDF. It is determined during a person’s Tzav Rishon to the IDF and affects the type of role and duties they will have in the military.

Click here for more information on IDF medical profile numbers.

I’m a medical doctor/dentist. Are there special IDF regulations for my case?

Yes. Doctors and dentists who make Aliyah have a different status regarding the duration of their military service. There is also a differentiation between male and female doctors/dentists. For more details, click here.

I am an only child. Will I have to serve in the IDF?

Yes, but there are special stipulations for your case. See here for more details.

What is Bituach Leumi?

Bituach Leumi, also known as the National Insurance Institute, is the government office responsible for social security in Israel. One of its primary responsibilities is to provide financial support for residents of Israel who are temporarily or permanently unable to support themselves. Check out our Guide for more detailed information.

Who is obligated to pay Bituach Leumi insurance premiums?

Bituach Leumi is compulsory for every Israeli resident who is 18 years or older, with a few exceptions. Eligibility for insurance benefits and the requirement to pay premiums is determined according to residency in Israel and not citizenship.

Who is exempt from paying Bituach Leumi insurance premiums?

There are various categories of individuals who are exempt from paying Bituach Leumi premiums. Some examples are housewives or a woman who is married to or the common-law wife of an insured person and who does not work outside her home and is not an Atzmai, someone receiving a permanent 100% KItzvat Nechut (work disability pension), soldiers in Sherut Sadir (regular military service) or an Israeli resident living in another country with whom Israel has signed a social security convention and who has paid social security in that country.

For more general information click here.

Are elderly immigrants eligible for Bituach Leumi pensions?

Elderly immigrants who make aliyah above a certain age are not eligible for a pension from Bituach Leumi unless they have no other source of income, in which case they may be eligible for a special pension.

If I temporarily move abroad, do I have to continue paying National Insurance premiums?

If you temporarily move abroad, you must continue to make monthly Bituach Leumi and Bituach Briut (National Health Insurance) premium payments. A delay in payments while abroad could delay your eligibility to receive Kupat Cholim (HMO healthcare services) for up to six months upon your return.

How long is someone considered an Israeli resident if they move abroad?

Bituach Leumi usually considers you an Israeli resident for the first five years abroad. After five years, you will need to prove that your residence overseas is still temporary.

If I move permanently to another country, what do I need to do?

If you move permanently to another country, you have to fill out a form and attach documentation proving that you have moved your primary residence out of Israel. This needs to be submitted within five years of leaving Israel.

Are Returning Residents eligible for Bituach Leumi benefits?

As returning residents, you are eligible for Bituach Leumi benefits but will be required to notify Bituach Leumi of your return and provide documentation proving that you have made Israel your main place of residence again. You will of course have to continue or restart to make monthly premium payments as well.

How much are the premium payments?

Bituach Leumi collects insurance premiums from all residents according to their income and insurance status and classification and pays benefits to all those eligible. For more details, click here. Fines (and interest) are levied for failing to pay the required taxes.

What type of benefits does Bituach Leumi provide?

Bituach Leumi pays benefits to those eligible, assisting people at times of personal crisis such as work termination, disability and work injury. You can view the main benefits here.

What is the connecetion between Bituach Leumi and unemployment?

Bituach Leumi may provide the unemployed person with funds for a limited time during his/her unemployment. You should report to the Sherut HaTa’asuka (Employment Service) immediately upon termination of employment, and then report on regular days as instructed by the Service.

What are the eligibility requirements for receiving a Kitzvat Nechut - קצבת נכות - Disability Pension?

- Age and Residency:

Israeli resident between 18 and retirement age.