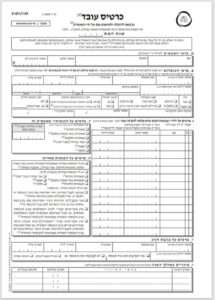

Employee 101 Form

Every employed worker is required to to fill out and sign a Kartis Oved – כרטיס עובד, also known as a Tofes 101 form which is required by Rashut HaMisim – רשות המיסים – the Tax Authority, to determine your tax obligations and credits. A new one is needed at the start of every calendar year or when you begin working during a particular year.

It is a two-page form and can be filled out by hand or digitally and functions as part of your contract, designed to ensure that you receive all the tax benefits you are entitled to and which tax credits appear on your Tlush.

TOFES 101 FORM

Section א: Pratei HaMa’asik - פרטי המעסיק – Employer information.

This should be filled out by your employer before you receive the form.

Section ב: Pratei Ha’Oved/et - פרטי העובד/ת – Employee information

In this section you need to fill in your Teudat Zehut number – תעודת זהות – ID number, date of birth, date of Aliyah, current address, gender, relationship status, whether you are a resident of Israel, whether you are a member of a kibbutz and if your salary is transferred to the kibbutz or is not, email address, phone number, and Kupat Cholim – קופת חולים – Health Organization. All of this information is important to ensure that your employer pays the right amount of Bituach Leumi and income tax for you.

Section ג: Information about your minor children - פרטים על ילדיי שבשנת המס טרם מלאו 19 שנה

In this section you list your children who are 18 and younger and who are listed in your Teudat Zehut, as each child under the age of 19 may entitle you to tax credits.

Put a check in column 1 next to the child’s information if they are in your custody. Put a check in column 2 if you receive Kitzvat Yeladim – קצבת ילדים – government child allowance, for them.

Section ד: Information about your earnings from this job - פרטים על הכנסותיי ממעסיק זה

In this section, you indicate whether your work for this employer is a full-time job, or a side job, if it’s part-time, shift work, a stipend, or a scholarship as well as filling in your start date of employment.

Section ה: Information about your earnings from other jobs - פרטים על הכנוסת אחרות

In this section, you need to declare any income you have from other jobs, if applicable. Check off the first option if you do not work at any other place and want to get the full benefits from your current employer.

Complete the second section if you do have extra income to declare by checking off the appropriate box describing the type of work and income etc. what type of income you have, then indicate if you are receiving your tax credits from your other employer.

If you are receiving tax credits from a different employer, you will need to file a Teum Mas – תאום מס – Income Tax Adjustment and a Te’um Dmei Bituach Leumi – תאום דמי בטוח לאומי – National Insurance Fee Adjustment, to ensure that you don’t pay these taxes twice.

Section ו: Information about your spouse - פרטים על בן/בת הזוג

You only need to complete this section if you have a spouse. If yes, fill in their name, ID number, date of birth, whether or not they have an income, and if they do, what type.

Section ז: Personal status changes that occurred during the tax year - שינויים במהלך השנה

Complete this section only if there were any personal status changes during the tax year. For example, did you move to the periphery? Have a baby? Or do anything else that would change your tax credits? If you want to know what changes might provide you additional tax credits, see Section ח below.

TOFES 101 FORM - 2

Section ח: Reasons for requesting a tax exemption or refund (Check all that apply)

:אני מבקש פטור או זיכוי ממס מהסיבות הבאות

1 – I am an Israeli citizen.

2 א – I have 100% disability/permanently blind (If yes, attach documentation from Bituach Leumi)

2 ב – I receive a monthly stipend according to the Handicapped Law or Victims of Terror Act. (If yes, attach proof of payment)

3 – I live in a town/city in the periphery that has an extra tax credit. (Make sure to fill in the date you moved in, add the name of the town, and include a proof of residency letter)

4 – I am a new oleh/olah. Add the date of your Aliyah on the blank line, and attach a copy of your Teudat Oleh.

- If you have not had any income in Israel during the current calendar year, until you started the current job – add the date you started to work on the second blank line.

- Someone whose eligibility was interrupted by military service, higher education studies or time spent out of the country should contact their local Rashut HaMisim office

5 – My spouse does not work and hasn’t earned any income this year. (This is only relevant if you or your spouse have reached retirement age or you declared a disability in item 2א above)

A person who checks off item 6 will also need to check off and complete item 7.

6 – I am a single parent living alone with custody of my children and receive Kitzvat Yeladim

7 – I am a single parent, who receives Kitzvat Yeladim, or a married woman, or an only parent. Next, check the relevant boxes below and add the correct number of children:

- Add the number of children born in the current calendar year

- Add the number of children turning 1 to 5 in the current calendar year

- Add the number of children turning 6 to 17 in the current calendar year

- Add the number of children turning 18 in the current calendar year

Note: The information here must match the information in section ג above.

8 – I am a parent (who did not fill in item 7) or an unmarried woman whose children are not in her custody or an only parent.

Next, check the relevant boxes below and add the correct number of children:

- Add the number of children born in the current calendar year

- Add the number of children turning 1 to 5 in the current calendar year

- Add the number of children turning 6 to 17 in the current calendar year

Note: The information here must match the information in section ג above.

9 – I am my child(ren)’s only parent, and they are in my custody

10 – I have children who are not in my custody for whom I pay child support. (These children should be listed in Section ג above)

11 – I am a parent of ___ child(ren) under the age of 19 with disabilities and receive Bituach Leumi benefits for them. (Attach documentation from Bituach Leumi)

12 – I am remarried and paying alimony to my ex-spouse. (Attach the court ruling)

13 – I am or my spouse is between the ages of 16 to 18.

14 – I recently finished my military or national service (Indicate the start and end dates of your service and attach your release letter)

15 – I recently received an academic degree (Bachelors, Masters or Doctorate), or a vocational training certificate

Section ט: I am requesting a Teum Mas for the following reasons

Here you fill out the information about your other employer and income (This is not your actual Teum Mas. You still need to file one separately. See Section ה above for more explanation)

Section י: Declaration - הצהרה

Here you date and sign that everything that you filled out is correct and that you will inform your employer of any future changes.

In general, if you have any questions about how to fill in the 101, speak to human resources department or the person who handles payroll at your place of work.